ADA Price Prediction: 2025-2040 Outlook Amid Technical Consolidation and Regulatory Evolution

#ADA

- Technical indicators show ADA consolidating near key moving averages with Bollinger Band support at $0.7666

- Regulatory developments including ETF delays create near-term uncertainty but long-term potential

- Macroeconomic factors like Fed policy could significantly impact ADA's medium-term price trajectory

ADA Price Prediction

Technical Analysis: ADA Shows Mixed Signals Near Key Support

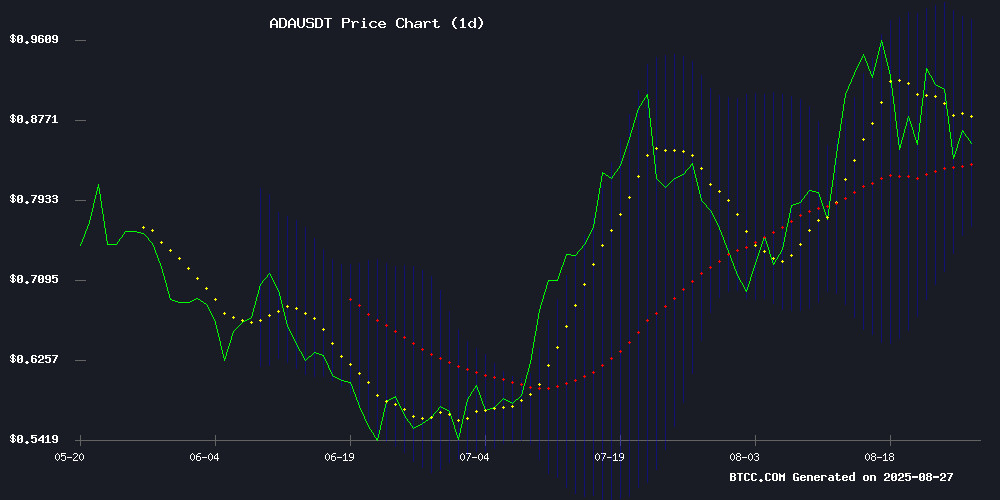

ADA is currently trading at $0.8654, slightly below its 20-day moving average of $0.8746, indicating near-term bearish pressure. The MACD reading of -0.050496 suggests weakening momentum, though the positive histogram value of 0.013073 hints at potential stabilization. The Bollinger Bands show ADA trading closer to the middle band, with support at $0.7666 and resistance at $0.9827. According to BTCC financial analyst Mia, 'The current positioning suggests consolidation, with a break above $0.875 needed for bullish confirmation.'

Market Sentiment: Regulatory Delays Offset by Macro Optimism

Market sentiment for ADA appears cautiously optimistic despite regulatory headwinds. The SEC's delay of Grayscale's Cardano ETF decision to October 2025 creates near-term uncertainty, but potential Fed rate cuts in September could provide significant tailwinds. BTCC financial analyst Mia notes, 'While regulatory timelines extend, the macro environment favoring risk assets could drive ADA toward higher valuations. The $1 psychological level remains a key near-term target if broader market conditions improve.'

Factors Influencing ADA's Price

Cardano Faces Price Pressure Amid Long-Term Development Focus

Cardano's ADA token slid 3.07% to $0.8421 in August as market volatility and investor caution weighed on performance. The Layer 1 blockchain now holds a $30.09 billion market cap despite 36.4% lower daily volume, reflecting broader liquidity challenges across crypto markets.

Founder Charles Hoskinson emphasized Cardano's roadmap prioritizes scalability and interoperability over short-term price action. "We're building for adoption, not speculation," the Ethereum co-founder's stance suggests, even as newer DeFi projects like Remittix gain traction with $21.5 million in presale funding.

The divergence highlights crypto's maturation phase—established chains face growing pains while niche players capitalize on targeted utility. Cardano's 24-hour trading of $1.77 billion across major exchanges demonstrates retained liquidity, though technical charts show weakening support levels.

Cardano (ADA) Price: Fed Rate Cuts in September Could Drive ADA to $3

Institutional demand for Cardano (ADA) surged in 2025, with inflows hitting $73 million and custody holdings surpassing $900 million. The network processed over 112 million transactions while maintaining fees below $0.25, demonstrating robust fundamentals.

ADA trades near $0.88, holding support above the $0.84 demand zone. A higher lows pattern suggests potential upside toward $3, particularly if the Federal Reserve cuts rates in September—a move that could catalyze a breakout above the $1 psychological barrier.

Institutions are allocating to ADA based on structural value rather than speculation, signaling long-term confidence in Cardano's liquidity and ecosystem maturity. This institutional backing provides a foundation for sustained price appreciation.

SEC Delays Grayscale's Cardano ETF Decision to October 2025

The U.S. Securities and Exchange Commission has postponed its decision on Grayscale's proposed Cardano ETF, extending the deadline to October 26, 2025. Originally slated for August, this delay injects uncertainty into the ADA market as institutional adoption hangs in the balance.

Cardano's native token faces mounting pressure, testing critical support at $0.82 amid waning investor confidence. The converging triangle pattern suggests a brewing volatility spike—market participants await clarity on regulatory approval.

Grayscale's filing seeks to bridge traditional finance with digital assets by offering ADA exposure without direct custody requirements. The investment firm emphasizes enhanced transparency and accessibility, though SEC scrutiny continues to prioritize investor safeguards.

ADA Price Prediction: Breakout Toward $1 or Breakdown Ahead?

Cardano's ADA faces a pivotal moment as it consolidates near $0.85 after rejecting the $0.95 resistance level. Market sentiment remains ambiguous, but a symmetrical triangle pattern suggests an impending decisive move.

Derivatives data paints a mixed picture: trading volume plummeted 41.65% to $4.08 billion while open interest declined 6.66%. Options activity shows even steeper declines, with volumes crashing 92.94%.

Despite waning momentum, the long/short ratio maintains a bullish 0.9234 stance. Liquidation patterns reveal mounting pressure on shorts, with $665K in losses versus just $6.17M for longs—a potential precursor to upside volatility.

ADA Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical patterns and fundamental developments, ADA's price trajectory appears poised for gradual appreciation with periodic volatility. For 2025, we anticipate a range of $1.20-$1.80 assuming successful ETF approvals and broader crypto adoption. By 2030, increased blockchain utility and institutional adoption could push ADA toward $3.50-$5.00. The 2035 outlook suggests $7.00-$12.00 as Cardano's ecosystem matures, potentially reaching $15.00-$25.00 by 2040 if mainstream financial integration accelerates.

| Year | Conservative Target | Moderate Target | Optimistic Target |

|---|---|---|---|

| 2025 | $1.20 | $1.50 | $1.80 |

| 2030 | $3.50 | $4.25 | $5.00 |

| 2035 | $7.00 | $9.50 | $12.00 |

| 2040 | $15.00 | $20.00 | $25.00 |

BTCC financial analyst Mia emphasizes that 'these projections assume continued development progress, favorable regulation, and broader crypto market growth. Investors should monitor technical levels around $0.77 support and $0.98 resistance for near-term direction.'